Date:2015-01-12 10:31:09

Internet bank depositors fled accelerated rise four lines

Internet bank depositors fled accelerated rise four lines

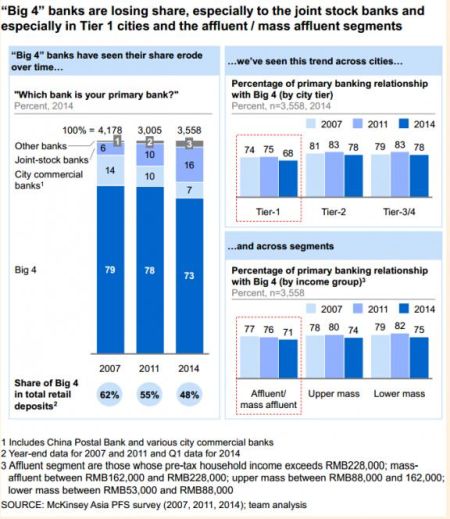

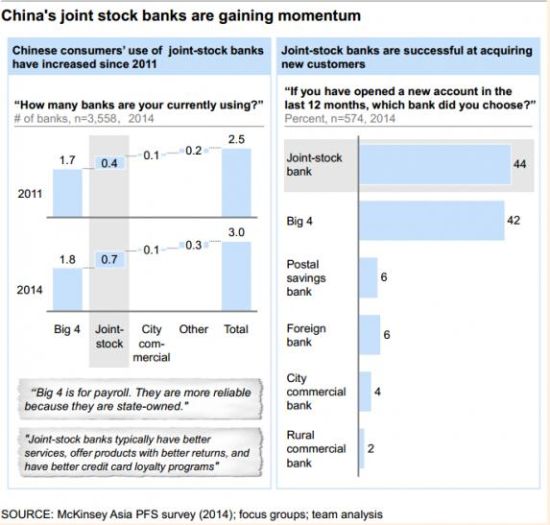

A global management consultancy McKinsey survey of consumers showed that with the rise of diversified financial product penetration tier cities, and Internet banking in the fast-growing retail banking business, Chinese state-owned "big four" are loss of market share.

Including the Agricultural Bank of China, Industrial and Commercial Bank of China, Bank of China and China Construction Bank, including the state-owned "big four" market share decline, the main beneficiaries of some joint-stock banks, such as investment, Everbright and CITIC Bank.

According to McKinsey research, affluent, and north to the four first-tier cities of Guangzhou-Shenzhen savers "evacuate" the four-line is particularly evident.

Survey shows that 73% of the respondents of the "big four" seen as their first choice, the ratio is less than 78 percent in 2011 and 79% in 2007. And the joint-stock banks seen as major proportion of respondents who bank deposits rose to 16 percent today from 6 percent in 2007, 10% in 2011.

The McKinsey study collected one, two, three, four-city total 3558 consumer survey results with the 2007 and 2011 compared the two results.

Loyalty decrease financial product penetration tier cities

Chinese personal finance customer loyalty main bank is low. While other banks raise interest rates more favorable, less than half of customers will stick with the original banking services, compared with about 70 percent in emerging Asia.

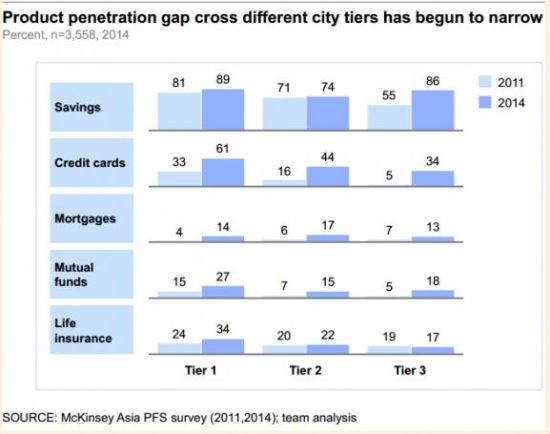

The report also found that the penetration of China in the third and fourth tier cities sharp rise in personal banking services, investment and insurance products, in recent years, narrowing the difference between first and second tier cities.

The figure shows that the three-tier cities, 34 percent of respondents said they use a credit card, but in 2011, this proportion has only 5%. The use of mutual fund investments in 2011 the proportion of respondents from 5% to 18%.

Digital Trends Internet banking rise

Internet banking by leaps and bounds in the past two years, the momentum was. Tencent micro led the congregation before the sea in foreign banks will start trial operation this month. As the first truly Internet banking, Tencent bank loan process future of the Internet will be fully realized.

Respondents, over 70% of people said it would consider a pure Internet banking (including by Internet companies offer financial services) account. And nearly 70 percent of respondents even consider pure internet banks as their main bank.